Corporation Registration

Standard

Plan Includes

- Nuans Search

- Preparation of the Articles of Incorporation

- Filing of the Articles

- Government Filing Fee

- *Deduct $50 if you only require a numbered company

Professional

Plan Includes

- Preparation of the Articles of Incorporation

- Filing of the Articles

- Nuans Search

- Government Filing Fee

- Corporate By-laws

- Corporate Minute Book

- Corporate Seal

- Blank Share Certificates

- * Deduct $50 if you only require a numbered company

Digital Minute Book

Plan Includes

- Organizational Resolutions

- Subscription of Shares and Share Certificates

- Register of Directors and Register of Shareholders/li>

- Consent and waiver for allotment/transfer of shares

- Corporate By-laws

- Minutes Shareholder’s Meeting /li>

- Appointment of Officers and Directors

- Ministry Form

Digital Minute Book Update

Plan Includes

- New Resolutions or Appointments (as needed)

- Change to Directors / Officers Registers (if needed)

- Consent from Shareholders (if needed)

- Ministry Form (if needed)

Minute Book Packages

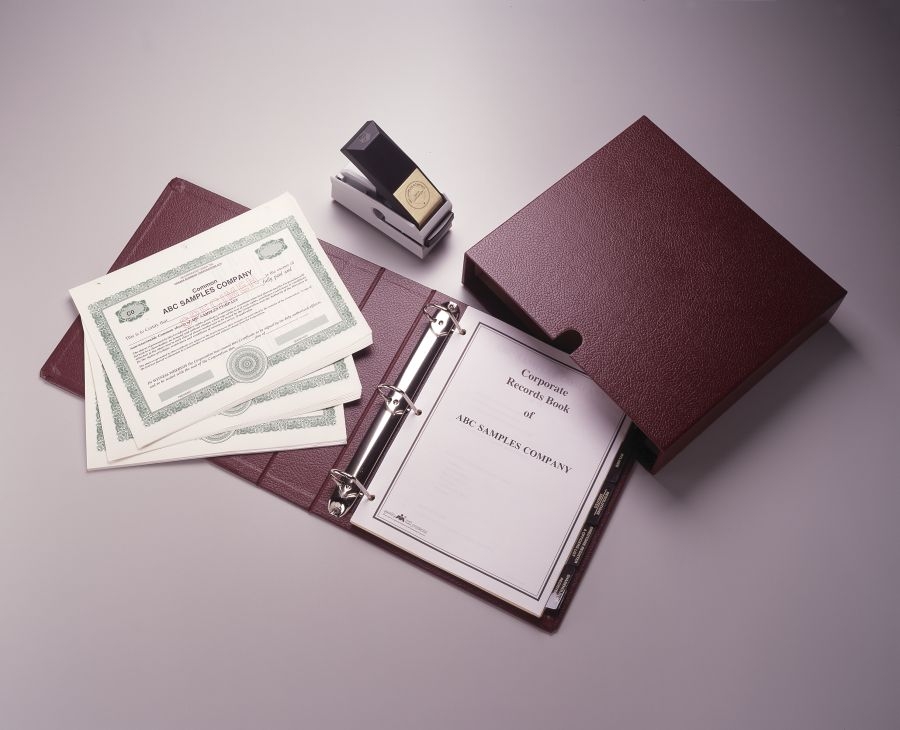

The Legacy Kit

The Attaché Kit

Seal/Embosser

Advantage of incorporating your business

Useful information that will help you understand Advantages about incorporating your business as well as will clear your basic doubts.

Step 1 - Advantages of Incorporating

A corporation is a separate and unique corporate with separate shareholders.

Advantages:

- Limited liability conferred on shareholders with respect to debts, obligations and liabilities of the corporation.

- Can have an unlimited number of owners . They are not liable for any other owner’s personal debt or to their creditors.

- Some government grants and programs are only offered to incorporated businesses.

- Ability to raise capital. The ability to issue various classes of shares with preferences as to dividends, redemption or convertibility and to utilize bonds or debentures greatly enhances a corporation’s ability to obtain funds for expansion or development.

- Corporations can offer shares to their employees as a form of profit sharing incentive thereby sharing in the profits and performance of that corporation without affecting control.

- Tax advantages. A corporation has tax planning and income splitting arrangements available.

- Continuous existence & ownership is transferable. The death or withdrawal of a shareholder does not affect the existence of the corporation, which enjoys perpetual succession.

- Ability to hold title to real estate and enter into contracts. A corporation can own real estate and sign contracts under corporate name.

Step 2 - Choosing the Name

Choosing the right name is important. You want a name that is easy to remember, will draw potential customers, help clients identify your company and build your business image.

Numbered Corporation

The first step is to decide if you will have a name for the corporation or use a "numbered company". There is no requirement for the corporation to have a name.

Named Corporation

Most people prefer to have a name for their corporation: to give it a unique identity, to avoid confusion with other corporations, and to give a general idea of the nature of the business to be carried on by the corporation.

Step 3 - Check availability of the name

Before making a final decision on your corporation’s name, you will want to know if someone else is already using the name by doing a preliminary name search that will allow you to check up to 3 names. A more accurate NUANS search is used when you want to be absolutely sure that your name is not used by someone else. A NUANS search is mandatory for incorporating a business with a name in Ontario.

Step 4 - Information required to register

To register your corporation in Ontario, you will need to provide:

- Name and address of the business.

- Fresh NUANS report - less than 90 days old

- Description of the business activity.

- Name and address of each Director.

- Name and address of each Shareholder.

You will need a minimum of 1 Director and Shareholder. One person can hold both positions.

Step 5 - Registered Address

Any corporation in Ontario must have an Ontario registered address. Many corporations often use a separate corporate registered address to keep important government correspondence separate from other corporate correspondence. This is even more important if you have a home-based business, because this allows you to maintain an increased level of privacy as corporate records are on the public record.

Step 6 - Filing Articles of Incorporation and Initial Return

Incorporation of the business is done by completing a document called Articles of Incorporation that is then delivered directly to the appropriate government department.

Once Incorporation is approved, you will receive the official Articles of Incorporation.

Articles of Incorporation consists of a legal document that confirms registration of your corporation with the Ontario government. Articles of Incorporation are valid in perpetuity.

Filing Initial Return

The Initial Return is a mandatory document that must be filed within 60 days after incorporation.

Step 7 - Corporate Minute Book, Seal and Share Certificates

A corporate minute book and registers are very useful organizational tools that project a professional image of any new corporation. Revenue Canada, a lawyer or any other authority would request to view your minute book in case they have any issues with your corporation. For that reason, you should have your minute book ready and updated at all times.

Step 8 - Apply for HST, Payroll, Import/Export and WSIB Accounts

- HST - Any business that generates more than $30,000 in annual taxable sales has to register for HST

- Payroll - Any business that has employees must register for a Payroll account

- Import/Export - If you are planning to trade with other countries, this account would be very helpful

- WSIB - This account is mandatory if you are going to have employees.

WSIB This account is also mandatory if you operate a business in the construction industry, even if you have no employees.

Step 9 - Corporate Trade Names

What is a Trade Name?

A trade name is any name under which you do business other than the current legal name on your corporate registration record. If you would like to use any name other than your corporate name you must register a trade name.

These are some important basic principles:

- There is no limit to the number of trade names that may be registered by one corporation.

- Trade names are not "protected" from use by other companies through trade name registration. To protect your name you need to register a trademark.

- You must use your corporate name together with the trade name on all contracts and legal documents. (ABC Ltd. o/a Balloons Are Us)

- Trade names have to be ordered separately from the incorporation process.